Why Cant I Withdraw Money From Td Ameritrade

The ultimate retirement account isn't technically a retirement account…

It's a Health Savings Account (HSA).

An HSA is a tax-advantaged savings account available for people who are enrolled in a high-deductible health insurance plan (HDHP).

Since people with HDHPs could face more out-of-pocket costs (due to the higher deductibles), the government provides tax incentives to motivate people to save for those expenses.

HSA account holders can contribute pre-tax dollars to the account and can then withdraw money from the account, tax free, when paying for qualified medical expenses.

And if used wisely (as described below), it could be one of the best places to put your money when saving for early retirement!

Warning: Do not confuse HSAs with other health-related accounts like FSAs and HRAs because they are very different and definitely aren't as good. This article is about HSAs only.

HSAs are Super IRAs

The HSA is billed as a savings account for health expenses but it's really the Clark Kent of retirement accounts because it's actually a super IRA in disguise.

Why is it a super IRA?

Before answering that, let's first briefly touch on some of the benefits of the various types of retirement accounts.

Tax-Free-Contribution Accounts

These are the most common retirement accounts (e.g. 401k, 403b, Traditional IRA) and are great for two reasons:

- Your contributions to these accounts are pre-tax contributions. This means that you don't pay any income tax on the money you contribute. For example, if you make $100,000 a year but contribute $15,000 to your 401(k), the IRS treats you as if you only made $85,000.

- The money in these accounts is able to grow tax free.

You eventually have to pay tax when you withdraw money but since you receive a tax break when you put money in and the money is able to grow tax free, it is usually worth maxing out these accounts to take advantage of these benefits (see why I think these accounts are best for early retirees).

Taxation on Traditional Retirement Accounts

Tax-Free-Withdrawal Accounts

Tax-free-withdrawal accounts (e.g. Roth 401k, Roth IRA) are different because they require you to pay tax on your income up front but the money grows tax free and you do not have to pay any tax when you withdraw the money after you reach the age of 59.5.

So using the salary in the above example, if you contribute $5,000 to a Roth IRA, you will still initially pay tax on your full $100,000 salary but you won't have to pay any tax when you withdraw the money from the Roth.

Taxation on Roth Retirement Accounts

HSA Accounts

For most of the population, an HSA is simply a savings account for medical expenses that provides some tax benefits.

Since you're a smart Mad Fientist reader though, I suggest you disregard the medical aspect of the account and simply think of it as a special retirement account that you are able to contribute to when you are enrolled in a high-deductible health plan.

When used intelligently, the HSA can potentially provide the best benefits of both a Traditional IRA and a Roth IRA because you are not only able to contribute pre-tax dollars, like you can with a 401(k)/403(b)/Traditional IRA, but you can still enjoy the tax-free growth and tax-free distributions that a Roth provides!

That means you could potentially have tax-free contributions in, tax-free growth, and tax-free distributions out. Or in other words, completely tax-free money!

Taxation on Health Savings Accounts

The best part is, you can take the distributions whenever you want (assuming you've had a qualifying medical expense after setting up the account) so this can be used to fund your early retirement!

Delaying HSA Distributions

Since there is no rule stating that you must use your HSA to directly pay for medical expenses or that you must withdraw money from your HSA within a certain amount of time after paying for a medical expense, you can just take out the money whenever you want.

As long as the qualified medical expense occurred after the HSA was opened, you can withdraw money from the HSA at any time after incurring the expense to reimburse yourself.

Example

Let's assume that I only spend $200 a year on medical expenses. It doesn't make sense to pay a lot of money for an expensive full-service health insurance plan, since I rarely go to the doctor, so I instead decide to get a cheaper high-deductible health plan with a lower monthly premium.

Since I have an HDHP, I am able to open a health savings account so I elect to max it out with $3,600 every year and I invest the account's money in a total stock market index fund.

Because contributions to the HSA are pre-tax, depositing $3,600 into my HSA decreases my taxable income by $3,600 and therefore reduces my taxes.

When I go to the doctor, I can pay for my $200 yearly visit with my tax-free HSA funds directly but if I instead pay with cash or my normal credit card, I am able to withdraw that $200 from my HSA at a later time (to pay myself back for the qualified medical expense).

The great benefit of having an HSA is that I can decide when to pay myself back. Since I am already maxing out my other tax-advantaged accounts and have ample savings, a $200 payment isn't going to break the bank so there's no rush to get paid back from my HSA. Instead, I am able to leave that $200 in my HSA to grow tax-free until I decide to withdraw it!

As long as I keep my receipts (and make digital copies, in case the physical copies wear out), I can withdraw the money for qualified medical expenses from my HSA at any time, in a similar way a retired person over age 59.5 can withdraw money from a Roth IRA – tax free!

So to summarize, I have saved myself from paying income tax on the $3,600 of income I used to fund the HSA, I now have $3,400 that is growing in the account tax free, and I have another $200 that is in the HSA growing tax free that I can withdraw whenever I want to!

Bonus: To keep track of how much of your HSA can be withdrawn prior to retirement age, click here to download a free copy of the spreadsheet I used on my own journey to financial independence!

Worst Case (or Best Case?) Scenario

I can hear you saying, "What if I put all this money into my HSA but I don't have any health issues…how will I ever get my money out?"

In this case, the account will simply act like a Traditional IRA but with an increased distribution age (65 instead of 59.5 for a Traditional IRA).

Like a Traditional IRA, your contributions to the HSA are pre-tax contributions and your contributions are allowed to grow tax free. If you don't use your HSA funds for medical expenses, you can begin withdrawing money from your HSA account for any expenses after you turn 65, without penalty. You'll have to pay income tax on any distributions that aren't for qualified medical expenses, just like you would with a Traditional IRA, but you won't incur any additional penalties or fees.

Therefore, after the age of 65, an HSA is nearly identical to a Traditional IRA but it's still better because your withdrawals for medical expenses are still completely tax free!

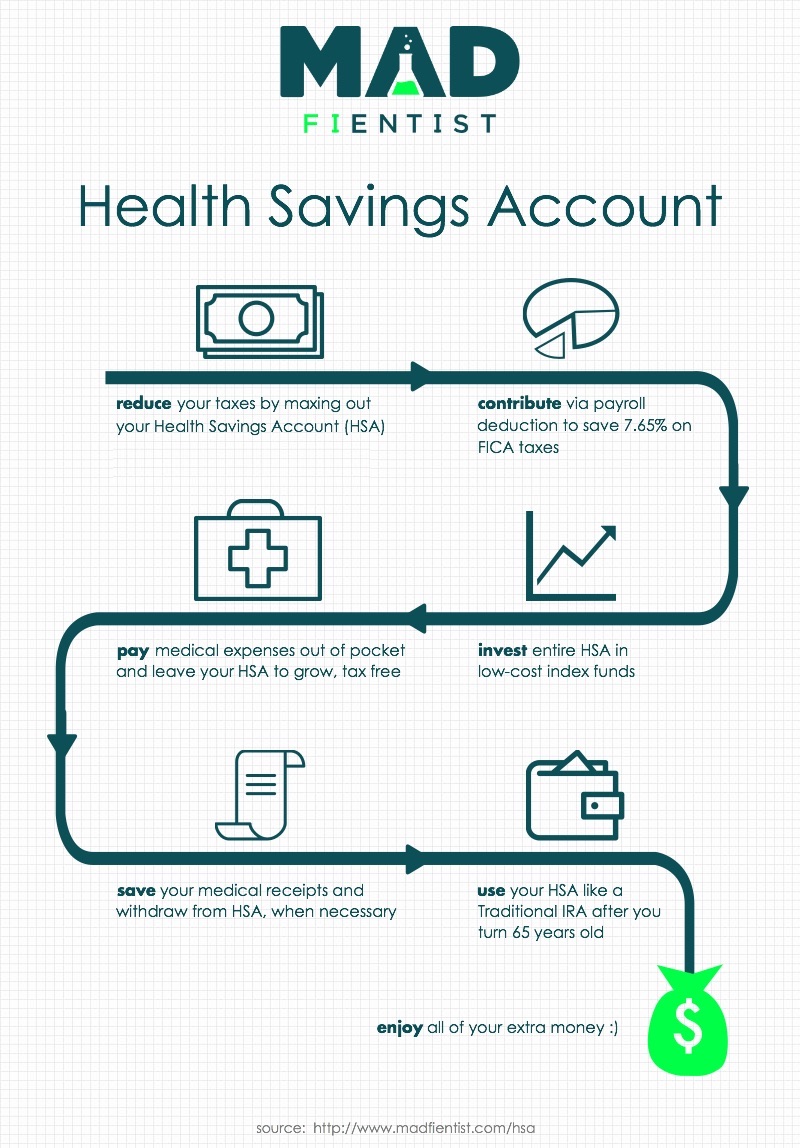

How to Maximize Your HSA

Here's a graphic explaining how future early retirees can take full advantage of an HSA (descriptions about each step are below):

Maximize the Benefits of a Health Savings Account

Max Out Your Contributions

Decrease your tax burden by contributing the maximum amount to your HSA each year and increase your savings rate by investing the tax savings.

The contribution limit for 2021 is $3,600 for individuals and $7,200 for families.

Assuming your family is in the 24% marginal tax bracket, maxing out your HSA could save you $1,728 in taxes each year!

Contribute via Payroll Deduction

When you contribute to your HSA via an automatic payroll deduction, you are able to avoid paying FICA taxes (i.e. Social Security and Medicare) on your contributions.

Assuming your family maxes out an HSA, this could result in an additional $550.80 of tax savings per year!

I am not aware of any other retirement account contributions that are exempt from the 7.65% FICA taxes so this is yet another reason the HSA is the ultimate retirement account!

Invest the HSA Funds

Rather than treat your HSA as a savings account, instead treat it as a retirement account and invest the entire HSA balance in low-cost index funds (note: not all HSA custodians offer low-cost index funds so make sure yours does before opening an account).

Don't Use your HSA to Pay for Medical Costs

Rather than use your HSA to pay for medical expenses, instead use your after-tax money so that you can leave your HSA money to grow tax free.

Keep Track of Your Medical Receipts

Keep track of all your medical receipts so you know how much you are able to withdraw from your HSA.

As you incur qualified medical expenses, you increase the amount that you can withdraw during early retirement (you effectively convert your HSA into an early-retirement Roth IRA over time).

Treat Your HSA as a Traditional IRA After Age 65

Assuming you reach the age of 65 and have not accumulated enough medical receipts to fully liquidate your account, the HSA can be used for ordinary expenses in the same way that a Traditional IRA can be used for any expenses after standard retirement age (note: withdrawals for qualified medical expenses will continue to be tax free but withdrawals for all other expenses will be taxed as income).

Things to Consider

Obviously you shouldn't switch to a high-deductible health plan just to take advantage of an HSA so do the math to see if an HDHP makes sense for your family before making the switch.

Employers are actually starting to make HSA contributions for their employees (which is great!) so factor those contributions into your calculation when deciding whether an HDHP is worth it.

Also, fees can sometimes be an issue with HSAs so make sure either your employer is covering the HSA fees or they are low enough to still make it worthwhile before setting up an account.

Conclusion

A health savings account is an incredibly valuable tool in an early retiree's arsenal, especially if you are already maxing out all of your other tax-advantaged accounts.

By treating your HSA as an additional retirement account, you can use it to further reduce your tax burden during your working years, shelter more of your investment earnings from tax, and potentially provide a source of tax-free income during your early retirement years!

What do you think? Do you agree that an HSA is the ultimate retirement account? If not, what type of account gets your vote?

Related Post

Why Cant I Withdraw Money From Td Ameritrade

Source: https://www.madfientist.com/ultimate-retirement-account/

Posted by: martineznevard.blogspot.com

0 Response to "Why Cant I Withdraw Money From Td Ameritrade"

Post a Comment